SARS Tax Number Registration | www.sars.gov.za

SARS Tax Number Registration | www.sars.gov.za; sars tax number application; sars tax number registration online

SARS stands for South African Revenue Service and is a national tax collection authority. Founded as an autonomous body under the South African Revenue Agency Act 34 of 1997, SARS is responsible for administering the South African tax system and customs service.

When an individual or business organization registers for a tax identification number, it is granted exclusively by the South African Revenue Service (SARS). This tax number has no expiration date and can be found on any document or letter addressed to the taxpayer. Here we’ll take you through SARS Tax Number Registration online process

SARS Tax Number Registration Online | www.sars.gov.za

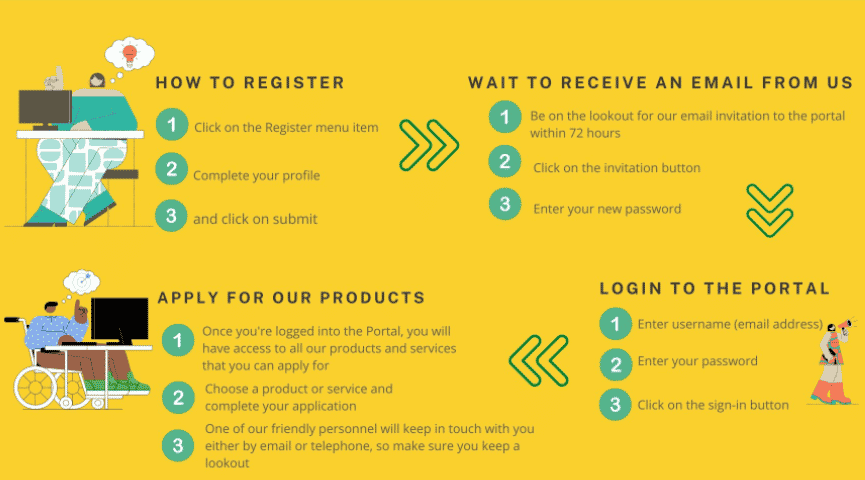

There are three ways to register for sars tax number which are as shown below

- Auto registration for Personal Income Tax

- Register through your Employer via SARS eFiling

- Request an eBooking appointment with SARS

Auto registration for Personal Income Tax

When you first register for SARS eFiling and do not have a personal income tax number yet, SARS will automatically register you and issue a tax reference number. Note that you must have a valid South African ID.

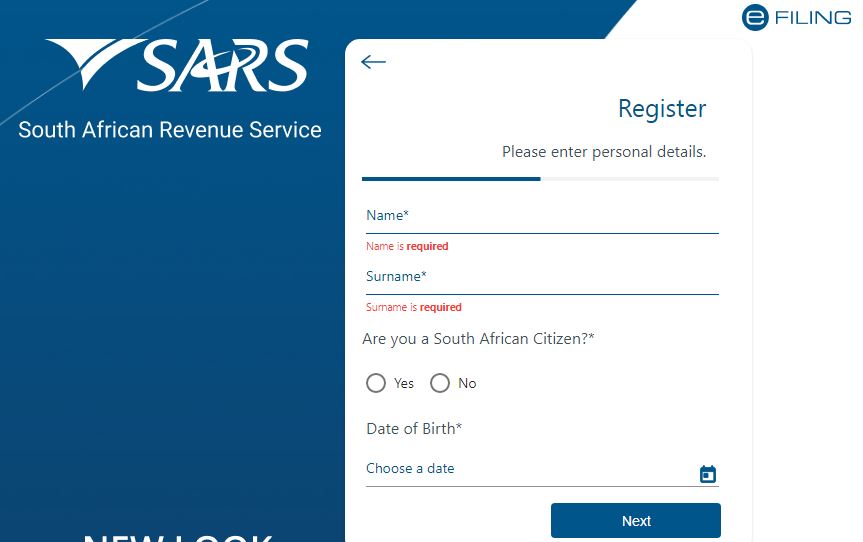

Follow these easy steps to register SARS Tax Number online using eFiling:

- Visit sars Efiling via the link https://secure.sarsefiling.co.za/app/register

- Once you open the link, you will find the SARS Tax Number Registration Form in which you will be asked to fill in your details as shown below

- Then Follow the prompts to complete registration

Register through your Employer via SARS eFiling

SARS eFiling offers the SARS registration function which allows employers to submit employee income tax registrations to SARS. For more information, see the Guide on Tax Reference Number (TRN) Enquiry Services on eFiling.

Request an eBooking appointment with SARS

If you are not yet registered with taxes, please note the following:

- You must have an appointment first before going to the SARS branch;

- The only way to make an appointment if you are not yet registered, is to call the SARS Call Center at 0800 00 7277 and select option 0 (zero).A SARS official will book the appointment for you.

The following two eBooking appointment channels are ONLY available if you are already registered for tax:

Send an SMS to 47277 (iSARS) with the information and format described below:

- Booking (Space) ID number/Passport number/ Asylum Seeker number

This SMS service is only available to taxpayers/registered representatives who are registered with Personal Income Tax (PIT).

This service is not available to tax practitioners. Learn More.

Read Also

Leave a Reply