SARS stands for South African Revenue Service Which is the nation’s tax collecting authority. Established in terms of the South African Revenue Service Act 34 of 1997 as an autonomous agency, SARS is responsible for administering the South African tax system and customs service.

SARS eFiling is a web-based system designed to allow users to submit returns, declarations, and other related services online for free. Taxpayers, tax professionals, and businesses can register for this free service online and make returns, declarations, payments, and other interactions with SARS in a secure online environment.

Taxpayers registered for eFiling can engage with SARS online for the submission of returns and declarations and payments in respect of taxes, duties, levies and contributions. Here we’ll take you through the basic procedures on SARS eFiling Login and also provides you with some useful tips to perform different task.

Which Services Can Be Accessed With SARS eFiling Login

The following services are available on eFiling:

- Pay-As-You-Earn (EMP201 return)

- Skills Development Levy (included on the EMP201 and EMP501 return)

- Value Added Tax (VAT201)

- Provisional Tax (IRP6)

- Secondary Tax on Companies (IT56)

- Individual Income Tax (ITR12)

- Trusts (IT12R)

- Advanced Tax Ruling (ATR)

- Change of Personal Details

- Payments

- Request for Tax Clearance Certificate

- Request for Tax Directive

- Transfer Duty

- Stamp Duty

- Security Transfer Tax(STT)

- VAT Vendor Search

- Notification Tool

- Tax Calculators

- Complete history of eFiling usage

How do I log into SARS eFiling?

To login into your SARS eFiling account you need to start by registering yourself. If you have already created account in SARS eFiling you can simply follow the steps below for the SARS eFiling Login

Open Web browser of your choice

Then visit the SARS eFiling Login page using the link >> https://secure.sarsefiling.co.za/app/login << oR click On the Link below to go to now

>Take me to SARS eFiling Login page Now<<

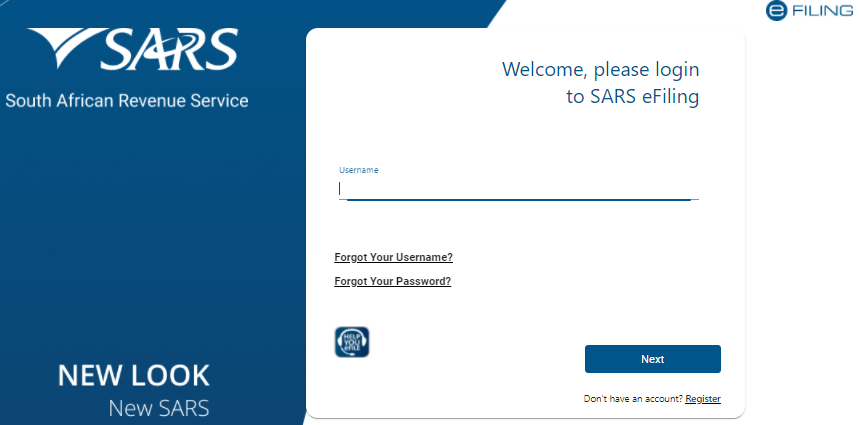

Once the above link open you will be on login page for SARS eFiling where you must enter your login details correctly ( user name and password then click Login as shown below)

If you Don’t Have Account In SARS eFiling You must start registration so that you can create your login name and password. Follow the steps below for SARS eFiling Registration

HOW TO REGISTER AS A NEW USER ON EFILING

a) Log on to the SARS website. On the top right side of the home page is a list of SARS eFiling options.

b) Select <Register Now>

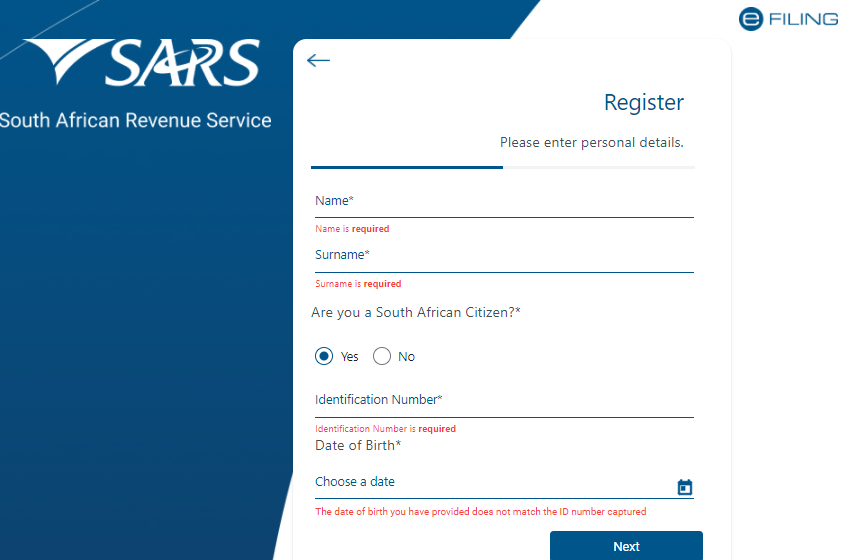

- The eFiling Register screen as shown below will display

Complete your personal details and click on Next Button

- Complete your contact and login details and click on Next Button

- If the details entered are successfully matched with the SARS records, you will be presented with the One-Time-Pin (OTP) screen

- Please enter the OTP that is sent to either your cellphone number or your email address

- If you do not complete the OTP process successfully, you will have to start the registration process again

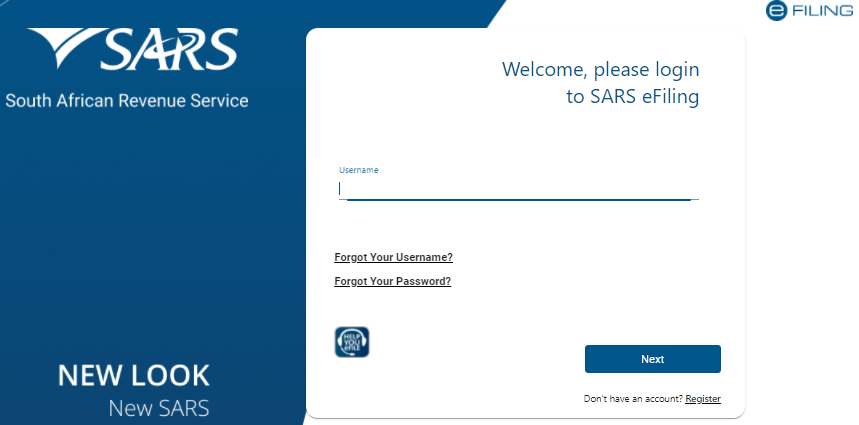

- Once you have successfully entered the OTP, the eFiling Login Screen will display (refer to the Login guide above to proceed with login into your account).

Please Note:

- If the system cannot match the personal details that you entered, you may be asked some random

questions to authenticate you. - If you have multiple income tax numbers or your income tax number is inactive/coded as

a deceased estate or you are only registered for VAT/PAYE and not for income tax, you

will be required to first visit your nearest SARS branch office to register for income tax or

activate your income tax number. - If the system identifies you as a registered eFiler, you will either have the option to login

with your existing eFiling profile or recover your password (if you cannot remember it).

Leave a Reply